You know you’ve entered the world of adulting when words like payment history, credit score, and credit repair start getting tossed around. Understanding these three terms is the first step in securing your financial position.

Defining credit score, payment history, and credit repair is the first step to gaining the financial freedom of your dreams.

What is a Payment History?

Payment history is really just a detailed record of all your past credit payments and whether you paid them on time or not. By looking at your payment history, lenders can see how you handle and repay any accumulated debt over time. Your payment history is also responsible for 35% of your credit score.

What’s the Difference Between a Credit Score and Payment History?

Your payment history reflects the length of your credit history, how much debt you have, and your spending habits. Your credit score, on the other hand, is a score that reflects your financial position using different financial details, including your payment history. It also factors in the following:

- Your debt

- Credit history length

- New credit accounts

- Your credit mix

Why is Your Payment History Important?

You should care about your payment history because it indicates your willingness and ability to pay off your long-term and short-term debts. Financial institutions will strongly consider your payment history when determining if you meet the criteria for more credit lines or higher credit limits.

Payment histories are calculated from accounts such as credit cards, loans, installment loans, and even mortgage loans. Credit accounts from finance companies and retail stores also influence your credit history. Next time you go to your favorite store and they ask if you want to save 20% off your purchase by opening a credit card, be careful. Depending on the credit accounts you’ve opened lately, this could impact your credit history.

The purpose of your payment history is to enable future creditors or lenders to see your lending habits. They want to feel like they can trust you to repay their money – wouldn’t you also want to lend your money to someone you knew would pay you back? If you’re paying your debt on time, this will positively affect your payment history, and therefore, your credit score.

How Will Your Payment History Affect Your Credit Score?

Your credit score is crucial because it shows whether or not you are in an excellent financial position. A good credit score shows banks, companies, finance companies, and even landlords, that you are in a stable and dependable financial place.

Since your payment history accounts for 35% of your credit score, lenders are required to report any late payments to all major credit bureaus, which also contributes to your credit score. The effect on your credit score depends on how recently you made a late payment and how often you pay late.

Using a credit monitoring service is essential to keep on top of your credit score. A credit monitoring service allows you to receive real-time updates on your credit score activity and will let you see whether or not your credit score is improving. Try out companies such as FreeScore360, RocketCreditScores, or myScoreIQ for credit monitoring. These companies offer a free 7-day trial, which is a great way to decide which one offers what you need.

What’s a Good Credit Score or a Bad Credit Score?

Knowing your credit score will give you an indication of what your next move should be. For example, good credit indicates that you’re on the right track, and poor credit could suggest that your spending habits are slowly getting out of control.

According to Equifax, credit scores are rated according to the following:

- A score of 580 or lower is rated as a bad credit score. This indicates a bad repayment history, a lot of debt, or both.

- Credit score of 580-669 is considered to be a fair credit score. Individuals with these scores are generally labeled as subprime borrowers.

- A score of 670-739 is a good credit score. These individuals are referred to as acceptable risk borrowers.

- 740-799 is considered an excellent credit score.

- Scores of 800 and up are considered excellent credit scores, and financial institutions will be more likely to lend to individuals with this score.

- And for the overachievers, there’s the perfect 850 credit score. We wrote an article about how to achieve a perfect 850 credit score.

How Are Credit Scores Calculated?

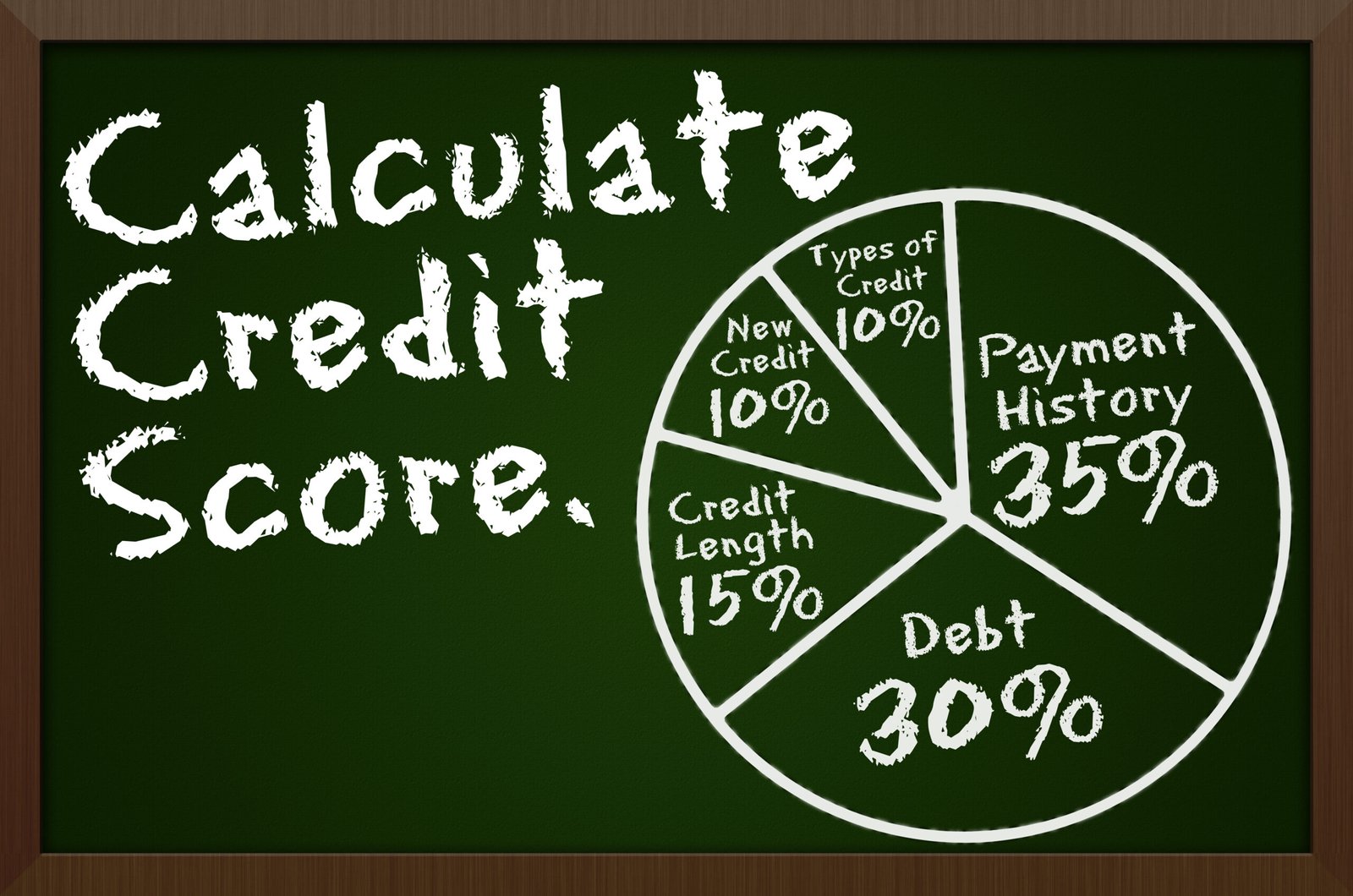

Now you know how credit scores are viewed, but you should also learn how these scores are calculated. Your credit score is calculated using a specific formula that determines whether you pay your bills at a good or a bad rate. We spoke about the categories used to determine a credit score briefly in the beginning, but here’s the exact breakdown.

Your credit score is essentially made up of the following factors:

- 35% is your payment history

- 30% is your debt or how much money you owe

- 15% is your credit history length

- 10% is your credit mix

- 10% is any new credit accounts you’ve applied for

Build Your Credit Score

For most people, there’s always room for improvement when it comes to credit scores. Building your credit score allows you lower interest and mortgage rates. Achieving a good credit score or credit history can sometimes be confusing, as your repayment history is not always reported to credit bureaus on time.

If you need some help building your credit score to your desired level, the following companies can help:

Better credit rates afford you the following benefits:

- The likelihood of loan approval

- Lower interest rates

- Better loan terms and conditions

Repairing Bad Credit Scores

A few missed payments could cause a lower credit score. It can be tough to maintain a good credit score, but there are ways to improve it if it starts to suffer.

If you are dealing with a poor credit score, you can improve your credit score by:

- First, check your credit scores for errors

- Then, make sure to pay your debts on time

- Lastly, do not close credit accounts, even if you don’t use them anymore, because they can improve your credit length

If you struggle with raising your credit score, you can always ask professionals for help. The following companies are excellent for helping you repair your credit scores:

In Closing

Once you understand how payment history and credit scores work, you’re on the right track to building the financial life you want. If you’re struggling to repair your credit and don’t know where to start, take the first step today by calling one of the credit repair companies listed on our website to get a free phone consultation.

About Monica Bulnes

Monica Bulnes is a business writer based out of San Diego, California. Monica received her business education from the top #7 best business school in the country, Rutgers University. She has worked in numerous marketing departments, including major multinational conglomerate, Panasonic. Her passion for personal finance and financial literacy is an extension of her passion for health and wellness. Monica truly believes that financial health is just as important as physical and mental health, considering the important role money plays in each and every person’s life. In her free time, you’ll find Monica inspiring the world through Instagram, writing in her journal, or sketching palm trees at the beach. To learn more about Monica and her writing, find her at www.writingbymonica.com.