You may know that hard inquiries can be bad for your credit score in certain cases. However, hard inquiries are part of having a credit score. This article will teach you everything you need to know about hard inquiries so that you can protect yourself against potential pitfalls.

What Is a Hard Inquiry?

When you receive a hard inquiry on your credit report, it means that a lender or company requested to see your credit history as part of an application process.

When Might You See a Hard Inquiry on Your Credit Report?

Also known as a “hard pull”, a hard inquiry can be found on your credit report after:

- Opening a credit card

- Applying for a car loan

- Taking out a student loan

- Applying for a mortgage

- Enrolling in a cell phone plan

These are just some of the reasons why lenders would need to look at your credit report.

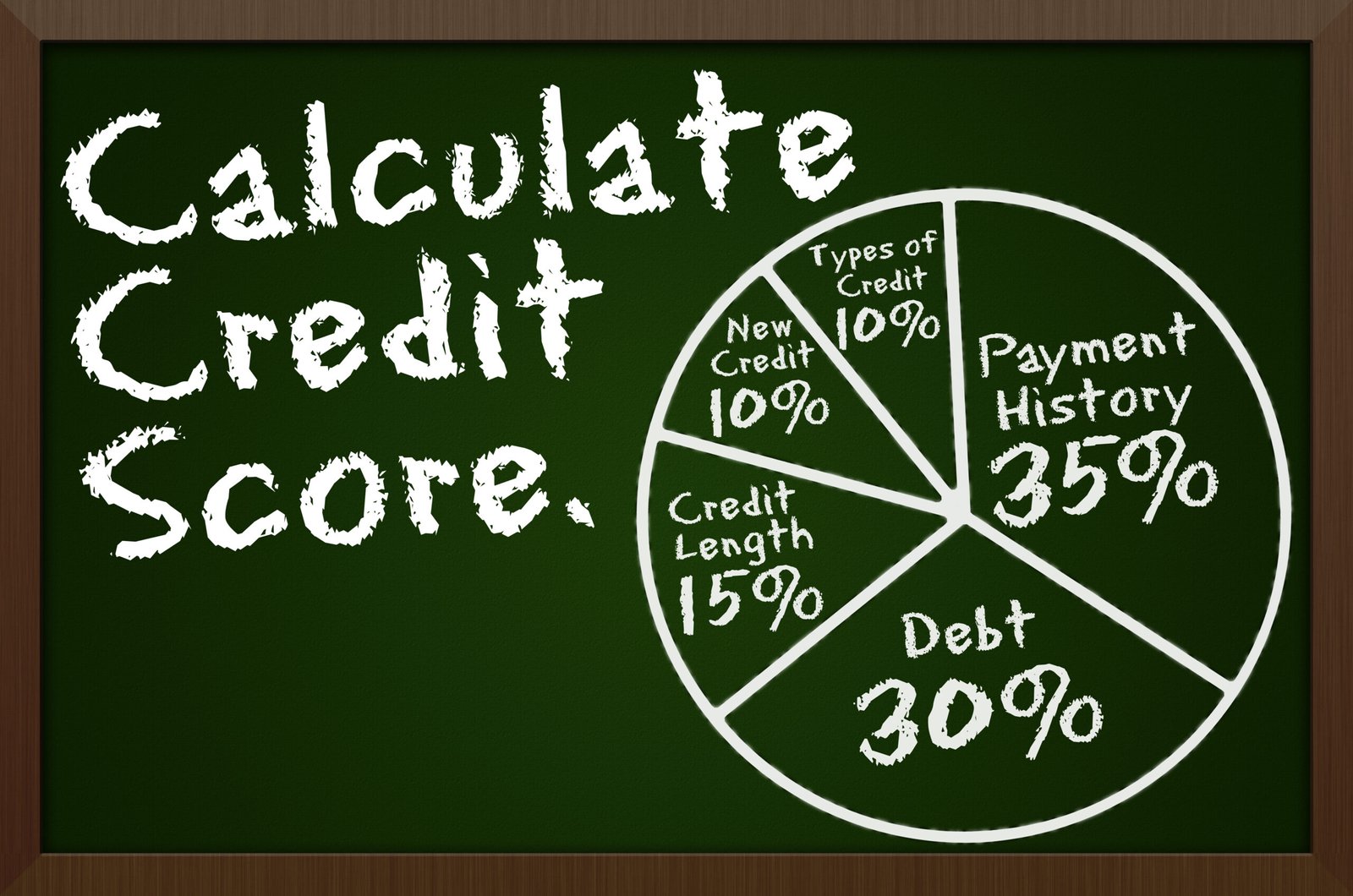

Any financial institution that lends you money for any reason is going to want to see your “creditworthiness”. Once they see you make your monthly payments on time and you don’t have large amounts of outstanding debt – among other reasons – then they can make a sound decision about lending you money. It’ll also help them decide how much money they’re willing to lend you.

How To Check For Hard Inquiries

If you’re not sure how to check if you have any hard inquiries on your credit score, FreeScore360 is one of the best credit monitoring services. You can check your credit report from the three main credit bureaus – TransUnion, Experian & Equifax – while receiving credit monitoring, ID Theft monitoring, $1M identity theft insurance, and even roadside assistance all for $29.99/mo.

We’ve also put together a list of top 5 free and paid apps for monitoring your credit score.

Hard Inquiry vs. Soft Inquiry

Soft inquiries, also called “soft credit pulls”, don’t affect your credit score. A soft inquiry can happen when a company or creditor checks your credit as part of a background check or to extend a pre-approval offer. Soft inquiries don’t impact your credit scores because they aren’t associated with a specific application for credit.

Another example of a soft pull is if a credit card issuer checks your credit without your permission to see if you might qualify for their credit card offers or if you had requested an increase to your credit limit.

Soft inquiries might not even be recorded on your credit report in some cases. Since they don’t change your credit score, they’re only visible on consumer disclosures, which are credit reports that only you can request.

How a Hard Inquiry Impacts Your Credit Score

Your previous credit history determines how much a hard inquiry will affect your score.

Hard inquiries tend to have the biggest impact on people with a short credit history or not many credit accounts. If you have a good credit history and credit score, there’s a chance that a hard inquiry won’t change your score much at all.

However, if you’re new to building your credit, try to stay away from hard inquiries as your score could take a big hit. Regardless, we want you to know that it’s normal to have hard inquiries every once in a while. It shows that you’re trying to build your credit.

As a rule of thumb, try to avoid having too many hard inquiries to your credit report in a short period of time.

How To Remove Hard Inquiries

If a hard inquiry shows up on your credit report because of a credit application you made, it can’t be removed. However, if you spot an unauthorized hard inquiry, you can write a dispute letter to your credit reporting company to request they remove it.

How Long Does a Hard Inquiry Last

Hard inquiries could stay on your credit report for about two years, but they only typically affect your score for the first 12 months. This varies depending on the credit bureau that’s reporting your credit score, which is why it’s important to view your credit score from all three major credit bureaus: Experian, TransUnion, and Equifax.

How To Raise Your Score After a Hard Inquiry

If your credit score is suffering due to a hard inquiry, consider giving Lexington Law a try to help repair your credit. They’re currently the top ranked credit repair company on Hello Genius with a 4.8 star rating. Their unique relationship with all three credit bureaus and their specific creditor intervention methods make them a great choice for quick and accurate credit repair. Read the full review now.

We have also ranked the best credit repair companies, featuring Credit Saint, another great credit repair company with a track record of 10+ years in the credit repair industry. Read our review.

In Closing

Hard inquiries are known as a negative event since they can bring down your credit score. We want you to remember that hard inquiries can also be an essential part of life at times.

It’s important to take out loans, open credit accounts, and many other events that are a normal part of life. As long as you’re aware of what can make your credit score take a nosedive, you should be able to maintain a healthy credit score while living a normal life.

About Monica Bulnes

Monica Bulnes is a business writer based out of San Diego, California. Monica received her business education from the top #7 best business school in the country, Rutgers University. She has worked in numerous marketing departments, including major multinational conglomerate, Panasonic. Her passion for personal finance and financial literacy is an extension of her passion for health and wellness. Monica truly believes that financial health is just as important as physical and mental health, considering the important role money plays in each and every person’s life. In her free time, you’ll find Monica inspiring the world through Instagram, writing in her journal, or sketching palm trees at the beach. To learn more about Monica and her writing, find her at www.writingbymonica.com.