Nowadays, debts come in all shapes and sizes, from credit card bills to student loans and mortgages to leasing cars. With such a wide variety of ways you can loan money, finding out how to pay your debts off is harder than ever. Where do you start? How do you know what to pay off first? You might even be wondering how to pay off debt in the first place.

Fortunately, you’re not alone– tons of people are in the same situation as you, and financial experts are here to help you unlock your inner genius. Here’s how you can get started paying off your debts:

Organize Your Debts

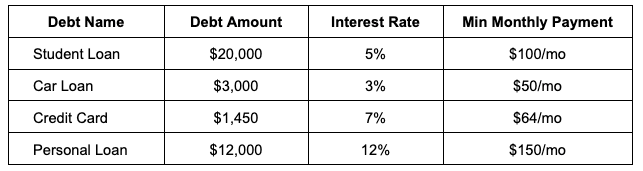

Before paying anything off, it’s always best to have a visual of your debts. Laying your basic debt information on a table (either digital or physical) is a great way for you to have a clear picture of your debts and how they differ. When you make a table for your debts, ensure you include your debt amount, the interest rate, and the size of your minimum payments.

When you finish, your table should look something like this:

Of course, the number of loans you have and their statistics will differ from ours. You may have more debts, fewer debts, or have consolidated some of your debts, like private student loans.

What Kinds of Debt are the Most Important to Pay Off?

Now that we have a visual, let’s start by determining which debts are the most important to pay off. Each type of debt affects your credit score differently, so when you find out which debts to prioritize, there are a few things to keep in mind: your debt amount, its interest rate, and how it affects your credit score.

Generally speaking, there are some debts you should prioritize over others:

Credit Card Bills

Credit card bills are often the first priority since they are usually smaller than student loans or mortgages. Credit cards are also revolving, meaning you will have to take out multiple cards within your lifetime. Because of this, your credit card payments are subject to higher scrutiny from lenders and are more likely to affect your credit score.

Credit card bills are your top priority if you prioritize your credit score while repaying debts. Missed credit card payments will severely impact your credit and your potential for lending in the future. Plus, credit card companies aren’t always as kind as a student loan company or a hospital– miss too many payments, and they’ll call collections.

Student Loans

Everyone has student loans these days, and they’re usually pretty hefty. However, there are tons of student loan debt relief programs available, and student loan companies understand that these debts are long-term. Although they can be pretty nerve-wracking, student loans aren’t something you’ll need to prioritize.

Car Payments

Car payments and other personal loans tend to have higher interest rates than student loans. These debts are best to hold at a medium priority level since, like credit cards, your interest rates will be higher. However, car payments and personal loans are also long-term investments, so you won’t be paying them off immediately.

If you’re working with the debt avalanche method, car payments and high-interest personal loans are a great place to start since they’re larger than most loans and still have higher interest rates.

Mortgages

Your mortgage is another big one, but it won’t have interest rates as high as your credit cards or personal loans because they use property as collateral. If you miss too many payments on a mortgage, the property you took out the mortgage for will be taken away.

Mortgages, like student loans, are designed to be long-term debt. They’ll take years to pay off, but unlike student loans, any interest accrued on them is tax-deductible. Your best bet for tackling these kinds of loans is to work at them slowly and steadily to ensure your property is safe.

Weigh Your Repayment Options

Based on the different kinds of debt you have and how your brain works, some repayment options may work better than others. Here are a few options for repaying your debts without seeking consolidation loans, settlement options, or help from other financial institutions:

Option 1: The Debt Snowball Method

The debt snowball method is best for tackling lots of debts bit-by-bit, starting with the smallest debt first. This method is particularly effective if you have a variety of small and large debts, with your smaller ones composed of credit card bills and larger ones composed of long-term debts like student loans or a mortgage.

With the snowball method, your goal is to pay off your smallest debt first. To start, you’ll need to make minimum monthly payments for all your debts. Then, set aside some extra funds each month to put towards your smallest debt. By prioritizing one debt at a time, you’ll knock out your smallest one first, then move on to the next smallest.

Option 2: The Debt Avalanche

The debt avalanche method works just like the snowball method, except this time, you’re starting with your largest debt first. This repayment method is especially effective if your largest debts have the highest interest rates.

For this method, you’ll continue paying each account’s minimum monthly payments but set aside a little extra cash to pay off your biggest debt. Once your largest debt is paid off, work on your next largest debt, and so on.

Option 3: Prioritize Credit

Similar to the debt snowball and debt avalanche methods, prioritizing your credit score revolves around making monthly payments but putting extra funds towards the debt that will most affect your credit score. With this method, you’ll most likely start with high-priority bills like credit cards or bills that have higher interest rates. This method will ensure that when you take out loans in the future, you’ll have lower interest rates and overall better deals.

Option 4: Handle Them All Equally

Our final DIY option is to handle all your payments equally and make your own repayment plan. This method is best if you’ve got a wide variety of loans that vary in priority or are subject to change priority over time. Just like the other repayment plans we’ve mentioned, a customized repayment plan is something that requires a lot of bookkeeping, especially when it comes to logging all your debts, their interest rates, and any additional notes about them. However, a customized payment plan may also grant you the most financial stability while repaying debts!

In Conclusion

Managing and paying off your debts may seem like a daunting task, but with a well-structured plan, it becomes more manageable. Start by organizing your debts, taking into account the debt amount, interest rates, and minimum payments. Prioritize your debts based on their impact on your credit score, with credit card bills typically taking precedence due to their potential to affect your credit negatively.

Simply choose the repayment strategy that best suits your unique financial situation, stay committed to your plan, and watch your debts gradually diminish, paving the way for a more financially secure future.

Still feeling overwhelmed and want a faster solution? Consider consolidating all of your debts into one simple payment. Check out our comparison guide covering the best debt consolidation companies.