Whether you’re working with student loans, car payments, a mortgage, or credit card bills, no one likes to be in debt. Debt is almost inevitable, and once you’re in debt, it can certainly feel like you’ve got no way out. The debt snowball method for paying off debt is one of the many tools at your disposal right from the start. Here’s how it works:

What is the Debt Snowball Method?

The debt “snowball” method is a type of accelerated debt-repayment plan which relies on individuals to pay more than the minimum amount for their bills. Accelerated repayment plans like the snowball method are more psychological than anything– you won’t have to sign up for any new loans or consolidate your debts, nor will you have to contact a financial expert (unless you want to).

How it Works

Essentially, your goal with the snowball method is to take on each piece of debt bit by bit, whittling them down over time, starting with the smallest amount of debt you owe. Once you’ve paid off the lowest debt, your payments will shift over to the next lowest debt, creating a snowball effect that makes debt feel more manageable.

Interest

While you’re paying off your debts, interest will accrue over time according to your account’s approved interest rate. With the snowball method, you’re paying more than your bill’s minimum payment amount for your lowest debt. This means you’ll pay off that loan faster, but the others will keep building interest over time. When you budget for this plan, make sure you take your interest rates into account!

Benefits of Using the Snowball Method

What people love most about the debt snowball method is that they can physically see their debt decreasing as they get fewer and fewer bills in the mail. The satisfaction of crossing out one debt after another carries over pretty quickly for some, and working in “baby steps” or small chunks is a great way to get started with anything daunting.

Drawbacks

The biggest drawback the snowball method has is that your interest will still accrue while you pay off debts. This will slightly alter your payment timeline each month, and with debts that you aren’t currently focused on, interest may build up faster than your minimum payments can work it off.

Another potential drawback to the snowball method is motivation; for this type of repayment plan to work, you’ll have to set personal goals and budget the entire plan yourself. Since no debt companies or bankers are involved, the whole process relies on your own motivations and willingness to keep at it.

If you aren’t too fazed by seeing your debts decrease in number alone, then this method might not be the best solution for you either. The debt avalanche method might work better in your situation.

Getting Started with the Debt Snowball Method

There are four steps to the snowball method for debt repayment, all of which are pretty simple:

Step 1:

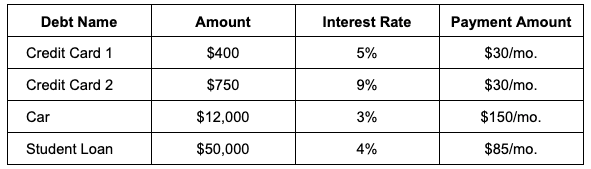

First, you’ll need to list all your debts, how much you owe for each one, and their interest rates. This way, you can visualize which debt is the smallest and put them in order. For example, let’s say we have a car loan for $12,000, $50,000 in student loans, and two credit card bills totaling $400 and $750. If your debts each have different minimum payments, include those in your list too.

Order them from greatest to least:

Step 2:

Now that we’ve got a visual representation of our debts, let’s start with the lowest bill. In our example, it’s the $400 credit card bill. Since clearing this debt is our first priority, we’ll set aside some funds larger than the minimum amount for you to pay each month. For the other bills, we’ll only pay the minimum amount. As you pay each bill, keep an eye on how it changes based on your interest rates for future budgeting.

Step 3:

Let’s say we make enough money to allocate an extra $70 to our first credit card bill, and pay the whole thing off in four months. That’s great! Now what?

Now, we move on to the next one. With one source of debt crossed off our list, things are already looking a bit more manageable in terms of bill payments. Let’s keep setting aside an extra $70 each month for the next bill.

Step 4:

Repeat the previous steps each time you pay off another debt. Add any new bills to your list, but focus on making extra payments for only one account at a time. If you get any new debts that are lower than the one you’re currently working on, finish your current payoff project before moving to the next lowest in your list.

Next Steps

For the snowball method to be successful, you’ll have to stay on time with your bill payments and be up-to-date on logging any new information about your various debts. The best way to do this is with a table or spreadsheet, where you can input information at any time and see all your information in one place. When you budget for your extra payments, make sure you leave enough room for necessities– you don’t want to end up dipping into your extra payment funds each month!

Still feeling overwhelmed and want a faster solution? Consider consolidating all of your debts into one simple payment. Check out our comparison guide covering the best debt consolidation companies.