When you’re saddled with debt, it’s hard to find a starting point for taking it down. In fact, it may even seem like your mountain of debt is unscalable. The avalanche method is one of the many ways you can handle your debts without any help from creditors or debt relief companies. Here’s how it works:

What is the Debt Avalanche Method?

As one of the two accelerated debt repayment methods, the debt “avalanche” method works similarly to the snowball method. Both repayment methods revolve around making minimum payments on all accounts while pouring extra money into one debt account until it’s completely paid off. Just like the snowball method, the avalanche method is entirely psychological– you won’t need to sign up for consolidation loans or work with debt settlement companies to utilize this system.

How it Works

The debt avalanche is pretty simple: your goal is to whittle down the biggest debts you have to knock big chunks out of your total debt. To do so, start by making minimum payments on all of your debts, and set aside a little extra cash to put toward your largest debt amount. Once you repay your largest debt, move on to the second largest, and work your way down.

Interest

While working with the debt avalanche method, it’s important to note that your other debts may accrue interest faster than your minimum payments can cover. While you pay off your largest debt, interest will build on your smaller ones and grow larger over time. Pay attention to each account’s interest rates as you pay off your debts to ensure your financial goals are accurate.

Benefits of Using the Avalanche Method

The debt avalanche method is excellent for people with large, daunting debts that may also have high interest rates. For many, it seems like the most logical step to take out their biggest debt first, especially if it’s a high-profile debt like a student loan or a car payment. Plus, seeing your largest debt get taken down is very satisfying.

Drawbacks

Of course, since the debt avalanche method works entirely on psychology, it won’t be as effective for people who grow impatient from not seeing any major change in their debts after a few months. Unlike the snowball method, you’ll have to take on your biggest debt first, which will take far longer than tackling a smaller debt.

Watching your debts’ interest rates may also cause some problems, especially if you have a smaller debt with a high interest rate– your smallest debt may become your largest, given enough time.

Another potential drawback of this method is self-control. It can be especially difficult to pay off one large debt without seeing any major changes. If this is the case, the snowball method might be best for you.

Getting Started with the Debt Avalanche Method

There are four main steps to working on your debts with the avalanche method:

Step 1:

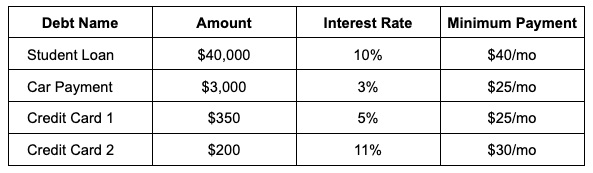

The first step to tackling your debt with the avalanche method is to list all of your debts. We recommend using a visual to see which one is the largest and ordering them based on size. When you order your debts, make sure you include each account’s interest rate, how much you owe, and its minimum payment amount. For example, let’s say we have a $350 credit card bill, a $40,000 student loan, a $3,000 car payment, and another $200 credit card bill. To order them, we’ll make a table like this:

Step 2:

Now that we have a visual, let’s start with the highest amount we owe: the student loan. Since clearing the student loan is our first priority, we’ll make minimum monthly payments on all of the other bills while paying a little extra for the student loan each month.

When determining how much extra you’ll add to your minimum payment, always keep your needs in mind– rent, food, utility bills, and saving for emergencies are all essential– don’t forget them! Let’s say we’ve got enough to set aside $50 each month as extra funds for paying off our bills.

Step 3:

By putting the extra $50 into our student loan payments each month, taking down that $40,000 debt will go much faster. Once that debt’s taken care of, it’s time to move on to your next largest debt. Based on your accounts’ varying interest rates, your debts might have shifted a little. For us, the second credit card bill is now higher than the first; we’ll have to pay that one off sooner now.

With the biggest debt out of the way, we’ve taken care of over half the money we owe in total! Let’s keep putting that $50 into our next debt to lower it faster.

Step 4:

Roll your extra funds over to the next largest account each time you pay off a debt. When a new bill comes around, make sure you add it, but keep your focus on paying off one debt at a time. If a new bill is larger than the one you’re currently paying off, you’ll still need to finish paying off that current bill before moving on.

Next Steps

In order for the avalanche method to work successfully, you’ll need plenty of self-control, patience, and planning skills. Always stay up to date on your debt status, and update your chart accordingly. Using a digital table in Microsoft Word or Excel is a great way to keep track of things. When you budget for extra payments, always make sure to put yourself first. If you have any extra cash you’re willing to spend on repayments at the end of the month, go for it! Just make sure your average baseline is something achievable regardless of how much you make each week.

Still feeling overwhelmed and want a faster solution? Consider consolidating all of your debts into one simple payment. Check out our comparison guide covering the best debt consolidation companies.