Finances can be tough, and wrapping your head around words like ‘credit utilization ratio’ can take time and practice. It’s worth it, though, because understanding your credit utilization ratio is an important piece of the credit management puzzle. This means understanding how the credit utilization ratio works, how your credit card behavior affects your credit utilization, and how your credit utilization is calculated.

Let’s break it down bit by bit so you can leave this article with a better understanding of what a credit utilization ratio is, how to calculate it, and three tips to improve it.

What is a Credit Utilization Ratio and How Does it Affect Your Credit Score?

Credit utilization is the ratio of total credit to total debt, shown as a percentage.

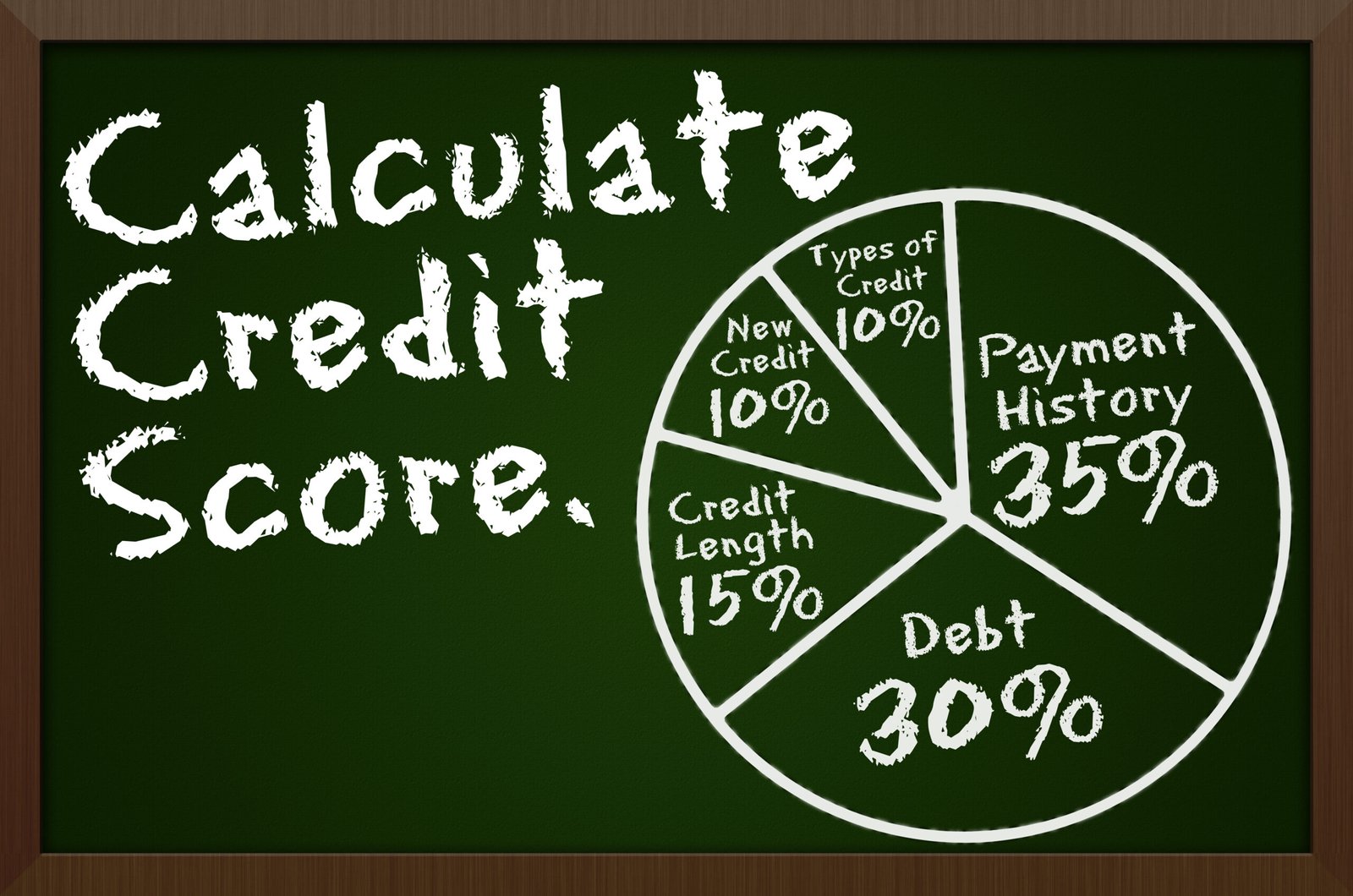

Your credit utilization ratio accounts for 30% of your credit score. It’s the second most important factor in determining FICO© and Vantage credit scores (your payment history is the most important factor). Carrying large credit card balances can increase your credit utilization ratio which often leads to a lower credit score.

A high credit utilization ratio indicates to a potential creditor that you’re not managing your credit well by overspending, which often leads to late or missed payments. That’s why having a high credit utilization ratio will lower your credit score. A low credit score can keep you from qualifying for mortgages, car loans, and credit cards. If you pay close attention to your credit utilization ratio, you can ensure your credit score isn’t negatively impacted when you need it most.

How is Your Credit Utilization Ratio Calculated?

Calculate your credit utilization ratio by following these easy steps:

- Add up your combined credit limits you have available on each of your credit cards (your credit limit is the total amount of available credit your credit card company makes available to you).

- Add up your current outstanding credit card balances.

- Divide your total credit card balances by your total credit limits.

- Multiply the result by 100 to calculate the percentage.

- Congratulations! You just calculated your credit utilization ratio.

Your credit utilization ratio is calculated using the balances reported on your credit report. It’s not necessarily what is shown on your credit card statement at any point in time. It’s important to be aware of the balances that are being reported on your credit reports to make sure there aren’t any errors or discrepancies. If you pay down your credit card balances, it can often take 30 to 45 days or longer before your new credit card balance is reported to the bureaus.

You can follow the same exact steps if you want to calculate the credit utilization ratio of individual credit cards. Pay attention to your utilization ratio with each individual credit card you own instead of just overall.

For example, let’s say you have three credit cards. The first card has a 50% utilization ratio, the second card has a 15% utilization ratio and your third card has a 25% utilization ratio. Your combined utilization ratio is 30% in this example. This isn’t the worst credit utilization ratio, but your card that carries a 50% utilization ratio can still hurt your credit score. If you’re able to pay off some credit card debt, the card with the 50% utilization ratio should be your top priority.

If this is still confusing, you can make it even easier by using an online credit utilization calculator.

One thing to remember is that your credit utilization ratio will change constantly. Every time credit card issuers send updates to credit bureaus, your ratio changes immediately. You can keep on top of any changes by using one of the top credit monitoring services we reviewed on this website.

What is a Good Credit Utilization Ratio?

There’s no exact number when it comes to a good credit utilization ratio, but experts recommend keeping your credit utilization ratio below 30%. However, it’s still fine to make purchases that exceed 30% of your available credit limit on occasion. If you do, make sure you pay them off within your grace period and avoid turning them into long-term debt.

Tips to Improve Your Credit Utilization Ratio

Now that you know what a credit utilization ratio is and how to calculate it, improving your credit utilization ratio is within reach, and you’re probably wondering how to get there.

Take a look at these handy tips:

1. Increase Your Credit Limit

Simply ask your credit card issuer for a credit limit increase. Most credit card issuers make it very easy to do this online when you’re logged into your account. You can also call the number on the back of your card to ask for an increase. If you’ve been a loyal customer for a year or more and have a good payment history, odds are very good you’ll get an increase. This can be the quickest and easiest way to improve your credit utilization ratio. But remember, just because you now have access to more credit, doesn’t mean you should spend it; that will put you right back to where you started but this time with even more debt.

Keep in mind – when you request a new credit limit, the credit card company might conduct a hard inquiry into your credit to see if you are “credit worthy” for an increase. This inquiry can temporarily lower your score by a few points but hard inquiries carry very little weight in your overall credit score calculation so there’s no harm in asking for a credit limit increase.

2. Don’t Close Zero Balance Credit Cards

It might be tempting to get rid of a credit card you’re not using anymore, but don’t do it. You reduce your total balance owed by paying off the card, which increases your total credit available. Keeping the card open will lower your credit utilization ratio and establish a long-standing credit history, which is very important and helpful.

If the annual fee on the card is high, try calling your card issuer to ask about moving you onto a more cost-effective plan. To continue receiving benefits from old cards, charge small purchases to the card on a regular basis to keep the account active and to continue building a positive payment history.

3. Apply for a New Credit Card

Applying for a new credit card is another way to increase your total credit limit. Looking for a card that offers an introductory balance transfer promotion is a great way to improve your credit utilization ratio. This is also an opportunity to move some high-interest rate balances over to a card with lower or even zero interest rates to save money on interest fees. If you’re able to save on interest, use the savings to pay down even more debt. Now that’s genius!

Again, keep in mind that a new credit card application will impact your credit score. The credit card company will make a hard inquiry into your credit before approving you. This is temporary, though; and in the long run, you’ll benefit from a lower credit utilization ratio.

In Closing

It’s vital to keep track of your progress now that you know how credit utilization works. Keep track of your credit card balances and utilization ratios on a monthly basis. Regular credit monitoring is necessary to track the health of your credit. As a rule of thumb, work hard to keep your credit utilization ratio under 30% to keep your credit score as high as possible.

About Monica Bulnes

Monica Bulnes is a business writer based out of San Diego, California. Monica received her business education from the top #7 best business school in the country, Rutgers University. She has worked in numerous marketing departments, including major multinational conglomerate, Panasonic. Her passion for personal finance and financial literacy is an extension of her passion for health and wellness. Monica truly believes that financial health is just as important as physical and mental health, considering the important role money plays in each and every person’s life. In her free time, you’ll find Monica inspiring the world through Instagram, writing in her journal, or sketching palm trees at the beach. To learn more about Monica and her writing, find her at www.writingbymonica.com.