Your credit score plays and extremely important role in your financial life. How much credit you get approved to spend on a credit card, interest rates, and payment amounts are just a few examples. Unfortunately, this all-important number can sometimes be complicated to understand and can leave anybody discouraged and disinterested in their personal finance.

While credit-scoring algorithms are mostly kept secret, there are a few key factors that we do know. These factors use information from the three main credit bureaus to determine your credit score.

Five Factors That Affect Your Credit Score Calculation

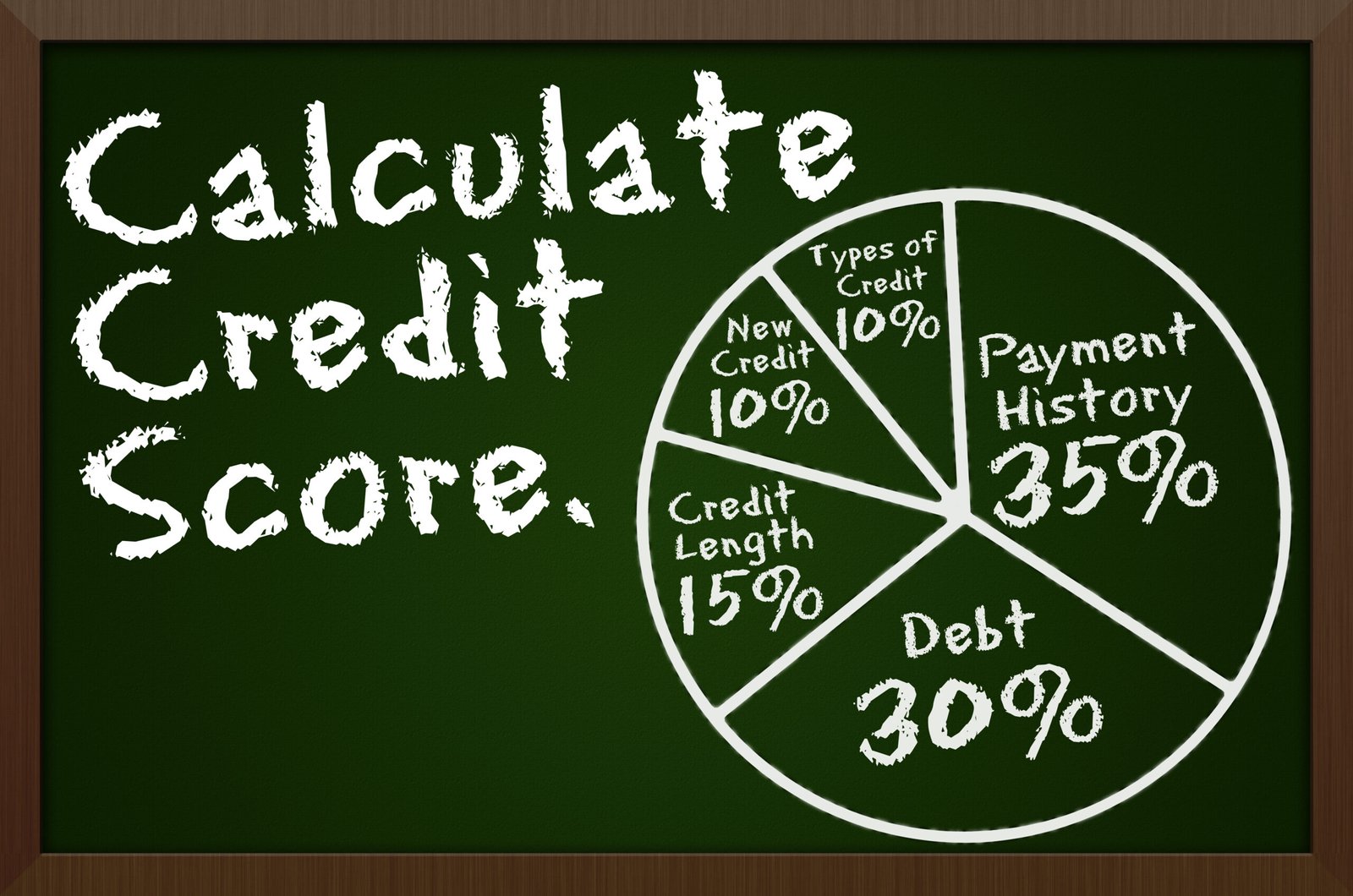

When your credit score is calculated, these factors are considered:

1. Payment History

Your payment history gives details on late or missed payments, bankruptcies, and collection information to a potential lender. It makes up a 35% of your credit score calculation, so paying bills on time and avoiding missed payments is extremely important.

A perfect payment history means you pay your bills on time, every time and never miss a payment. Just one late or missed payment can cause your credit score to drop significantly. And if you have multiple late or missed payments, your score is likely to end up in the tanks and will need to be addressed as soon as possible. If your payments are more than 30 days late, these are usually reported by your lender, so the negative impact can happen quickly.

The good news is that if you are able to improve your payment history, it can also help improve your credit score just as quickly. Often times, if you only have one late or missed payment, it is possible to call your creditor and ask for forgiveness and if they see that it was just a one-time honest mistake, they’ll often agree to remove it from your payment history and update the credit bureaus.

If you happen to have several issues with your payment history that need to be repaired, working with a professional credit repair company will be required to help you fix the issues, although results can not be guaranteed.

2. Amounts Owed

The total amount of debt you owe to your creditors is the second most important credit score factor when determining your credit score, accounting for 30% of your credit score calculation. Your credit utilization ratio is the grand total of all your outstanding debt balances, divided by the total amount of your available credit, also known as your credit limits. This calculation helps potential creditors determine if you already have too much debt to pay down, which increases your risk profile suggesting that you might be likely to miss a future payment because you can’t afford to make the payment. In other words, you’re over extended.

A large amount of debt from too many sources will hurt your credit score. Both revolving credit and installment credit are taken into account during calculation.

Revolving Credit is an open-ended credit account, such as a credit card, that can be used and paid down continuously as long as the account stays open.

Installment Credit is a specific type of loan that includes a predetermined amount of money that needs to be repaid over time, such as a car loan or a mortgage.

3. Length of Credit History

This factor makes up 15% of your credit score and takes into account how long you’ve had your credit accounts open for. When considering length of your credit history, credit scoring models look at the age of your newest account, oldest account, and average age of all other accounts. If most of your accounts are new, that makes it hard for a potential lender to get a sense for how likely you are to make your payments on time every month.

Lenders want to see that you have a healthy credit history. Accounts kept open and active for years that are in good standing benefit your credit score. Any closed accounts only factor in your credit report for up to 10 years. Avoid closing old accounts and instead keep them active and current Keep older accounts to help boost your credit history. The best way to keep an eye on all of your accounts it to sign up for a credit monitoring service to help keep an eye on all of your accounts.

4. Credit Mix

Credit scoring models also consider how well you maintain revolving credit (credit cards, gas station cards, retail store cards) and installment credit (mortgages, auto loans, and student loans). Lenders want evidence that you can responsibly handle multiple types of accounts.

You don’t necessarily need to have one of each type, but it can help to have a good credit mix. Your credit mix makes up 10% of the credit score calculation, so it’s definitely something to keep in mind.

Having certain accounts could also help you build an excellent credit score. Different accounts are beneficial for specific credit score models because different lenders can have their own credit score models. A great example of this is auto loan lenders. Having well-managed installment credit is one way to improve a low score or maintain an excellent score.

5. New Credit

New credit makes up 10% of your credit score calculation and believe it or not, opening new accounts isn’t what impacts your credit score – instead, it’s the act of applying that changes it. New applications usually require a hard inquiry, and these inquiries usually lower your credit score for a short period of time. A new credit account also impacts your credit history length, especially if you don’t have too many older accounts to balance it out.

However, it’s important to be cautious about how many accounts you open at a time. Opening new accounts too often will give lenders a red flag, making them think you might be having troubles getting approved by other lenders. On the bright side though, adding a new credit card can improve your available credit and your underlying credit utilization ratio.

When Are Credit Scores Updated?

Credit scores are generated upon request, unlike credit reports that are updated when lenders send updates to credit bureaus. This means your credit score can change daily depending on how your credit report changes. When your credit report is updated, the new information will reflect changes in your score whenever it’s calculated. It’s a good idea to check your score at least once a month as part of a proactive financial management plan.

Final Thoughts

While knowing how to calculate your credit score isn’t necessarily required, knowing what goes into the calculation is. Understanding these important factors can help you keep your credit on track. If you have a poor credit score, fixing it is much easier when you know which areas of your credit report you need to focus on. Want to take a look at your credit score? Check out these top 5 free and paid apps for monitoring your credit score.

About Monica Bulnes

Monica Bulnes is a business writer based out of San Diego, California. Monica received her business education from the top #7 best business school in the country, Rutgers University. She has worked in numerous marketing departments, including major multinational conglomerate, Panasonic. Her passion for personal finance and financial literacy is an extension of her passion for health and wellness. Monica truly believes that financial health is just as important as physical and mental health, considering the important role money plays in each and every person’s life. In her free time, you’ll find Monica inspiring the world through Instagram, writing in her journal, or sketching palm trees at the beach. To learn more about Monica and her writing, find her at www.writingbymonica.com.