Some services charge a fee to check your credit score, but there are a few ways to get a free credit score check.

Why Should You Check Your Credit Score?

Your credit score determines if you’re eligible for loans, new credit cards, mortgages, and other money-borrowing. If you know what your credit score is before you allow other financial institutions to look at it, you can make better decisions about what you apply for.

If you see you have a low score, you can be cautious about applying for new credit and work on improving your score instead.

Your credit score is one of the most critical components of your financial position that lenders look at before approving you. Banks, financial institutions, and retailers use your credit score to assess your financial stability. Checking your credit score gives you a better understanding of where you stand and where you can improve.

Is It Safe To Run a Free Credit Score Check?

Checking your credit score is completely safe. It’s not considered a hard inquiry, unlike when a lender checks. A free check won’t lower your credit score in any way and doesn’t show up on any of your reports.

You do need to be aware of scams and fraudulent websites on the internet that may promise a free credit score in exchange for your personal information. This is extremely dangerous because credit score checks require your name, address, date of birth, and social security number. If your social security number falls into the wrong hands, you could have your identity stolen.

If you’d like to protect your privacy, these top credit monitoring services offer free identity theft protection with their monthly packages that also provide you with credit reports from the three main credit bureaus.

What Determines Your Credit Score?

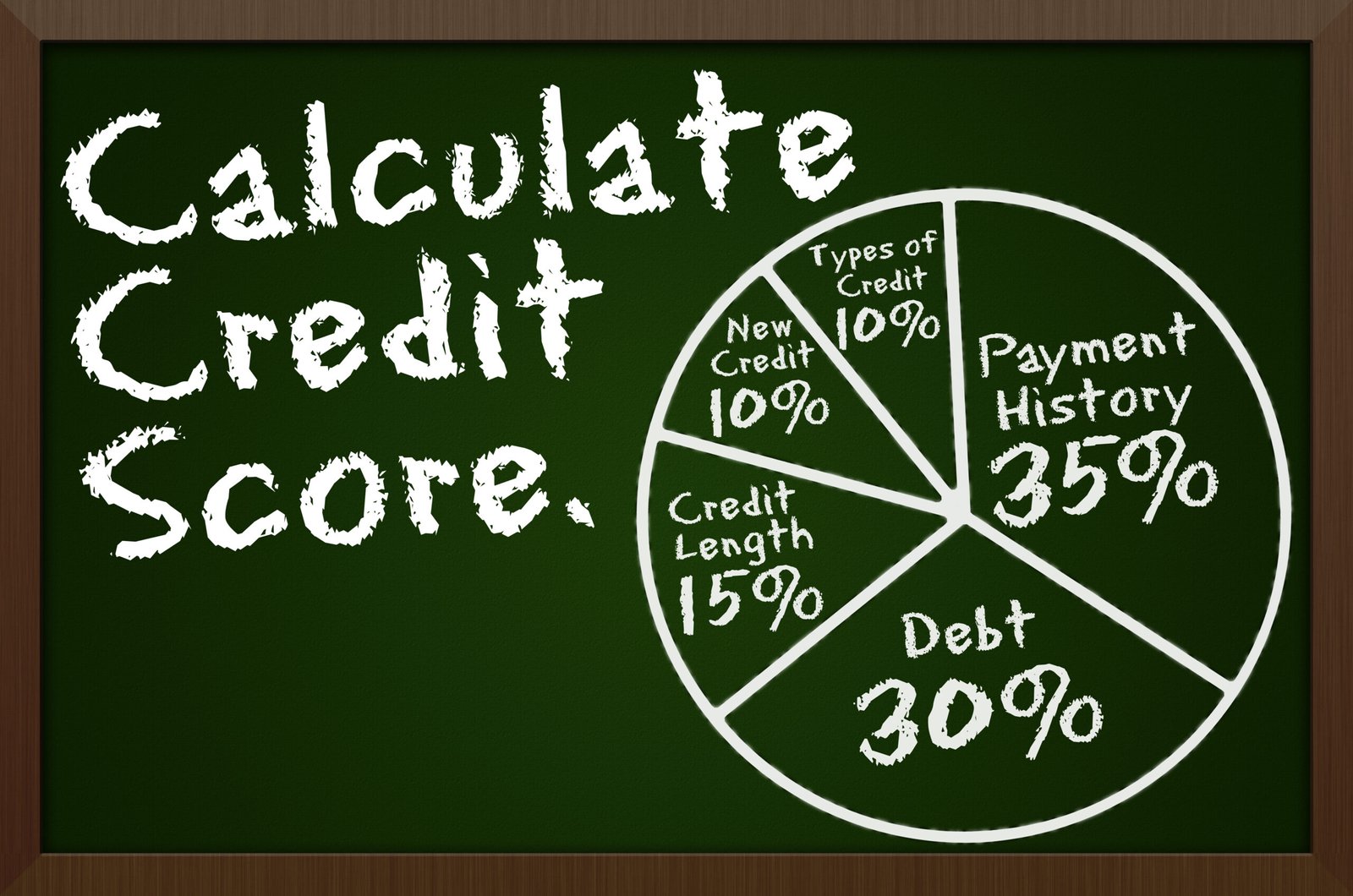

A credit score is not a random number that credit companies assign you to. It’s actually calculated using different components from your credit report. These points are considered when calculating your credit score:

- Payment history

- Amounts owed

- Length of credit history

- New credit accounts applications

- Types of credit accounts (credit cards, car loans, mortgages)

This information is retrieved from your credit report, calculated, and then converted to a score that lenders and creditors use to evaluate credit risk. Lenders will use this number to decide if they want to lend money to you. If they do, your credit report also helps them determine the interest rate they will charge you. Even if you’re approved, if you have a lower credit score, it will likely result in a higher interest rate, which means higher fees for you. So it’s really important to keep your credit score as high as possible so you can save as much as possible.

The FICO® or VantageScore® scoring model is applied to the most recent data from any of your credit reports when your credit score is checked. Many lenders prefer using the FICO® model because of its accuracy and reliability.

How To Check Your Credit Score For Free

There’s a difference between your credit report and your credit score – they don’t always go hand-in-hand. If you access your credit report, it typically doesn’t include a credit score, and vice versa. Getting a free credit score can often be a challenge, but here are three ways to do it:

1. Banks and credit card companies

Most credit card companies and banks like American Express, Capital One, and Chase, will provide a free credit score to their customers on their monthly statements.

These companies offer you this service through the FICO® Score Open Access program. This FICO® program enables banks and credit card companies to share FICO® Scores with their customers. These credit scores are the exact ones used to assess your credit risk.

2. Credit scoring sites

A few third-party credit scoring services offer users free credit score checks. Some are entirely free, and others are free when purchasing other services. If you sign up for credit monitoring services from FreeScore360, Rocket Credit Scores, or myScoreIQ, you will have access to free credit score checks. All of these sites offer a 7-day free trial.

3. Non-profit credit counselors

Not many people know about this, but non-profit credit counselors are available to help if you’re struggling with your credit. Part of this help includes access to credit reports and credit scores. They also assist in breaking down complex topics to make credit easier to understand.

Why Do Credit Scores Vary By Credit Bureau?

Credit bureaus have different systems when it comes to generating credit reports. These little differences can affect the results you get from each one on a given date.

Some differences that cause credit scores to vary by credit bureau:

- Incorrect information on your credit report. Credit reports can contain errors. They can be easily fixed, but it’s still possible for them to reflect an incorrect credit score. That’s why regular credit monitoring is essential for ensuring mistakes aren’t dragging down your credit score.

- Date of balances on your credit report. Credit bureaus don’t receive updated information from lenders on the same date every month. This difference in timing will affect your credit score calculation sine the balances will be different.

How Will You Know If You’re in a Good Credit Score Range?

Once you’re able to access your free credit score, now you need to understand what your credit score means. Credit scoring formulas are primarily based on the 300-850 range, according to Experian. You’re in a better position with lenders with a score of 700 and above.

- Exceptional: 800-850

- Very good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

My Credit Score Is Bad – Now What?

If you’re just noticing that your credit score isn’t in the best shape, don’t stress. Check out these 5 fast and easy ways to raise your credit score. There are also incredible resources out there, such as these top 5 credit repair companies. Slow and steady wins the race when it comes to raising your credit score. Whether you decide to raise it yourself or hire professional help, it could take years to raise your credit score depending on what’s dragging it down. Have patience and you’ll see the results you’re looking for!

The bottom line

Checking your credit score couldn’t be easier at this time. With various free services available, it’s hard not to be more informed on your financial standing. Test the various available ways to see what works best for your financial planning.

About Monica Bulnes

Monica Bulnes is a business writer based out of San Diego, California. Monica received her business education from the top #7 best business school in the country, Rutgers University. She has worked in numerous marketing departments, including major multinational conglomerate, Panasonic. Her passion for personal finance and financial literacy is an extension of her passion for health and wellness. Monica truly believes that financial health is just as important as physical and mental health, considering the important role money plays in each and every person’s life. In her free time, you’ll find Monica inspiring the world through Instagram, writing in her journal, or sketching palm trees at the beach. To learn more about Monica and her writing, find her at www.writingbymonica.com.