Whether it’s student loans, car payments, or credit card bills, debt can crush anyone– so how do you get out of it? It can be hard trying to figure everything out on your own, which is why we’re here to help: here are our six favorite ways to work on getting out of debt:

1- Paying off Debts With the Snow Methods

The first, most reliable way to get out of debt is simply paying it off. However, one does not simply “pay off debt.” When saddled with bills and other expenses, it’s hard to find where you should start. Generally, there are two methods to paying off debt over time that we’ll call the snowball methods.

The “Snowball” Method

The first method we will cover here is the “snowball” method of debt payoff. In the snowball method, you’re working in little steps that eventually build up (like a snowball). Your first goal is to start with the smallest amount of debt you have. For example, if you have a $10,000 student loan, a $3,000 car payment, and a $250 credit card fee, you’ll want to start with the credit card first. Pay your bills on time, and then take any extra cash and put it towards paying off that lowest bill.

The benefit of the snowball method is the psychology behind it. By breaking your debt into smaller pieces, they’ll feel easier to tackle and focus on one at a time.

The “Avalanche” Method

The second method, called the “avalanche” method, works a bit differently than its fluffy counterpart. In the avalanche method, your goal is to pay minimum amounts for all your monthly bills. Then dedicate any extra funds you have for that month to paying off your biggest debt. In the same situation as before, you’d be paying $50 per month on each bill, then putting any extra cash towards paying off that hefty student loan.

The avalanche method is meant to keep people paying bills on time– this is especially great if you’re working on building good credit, and it can be quite satisfying to watch your big mountain of debt slowly fall away.

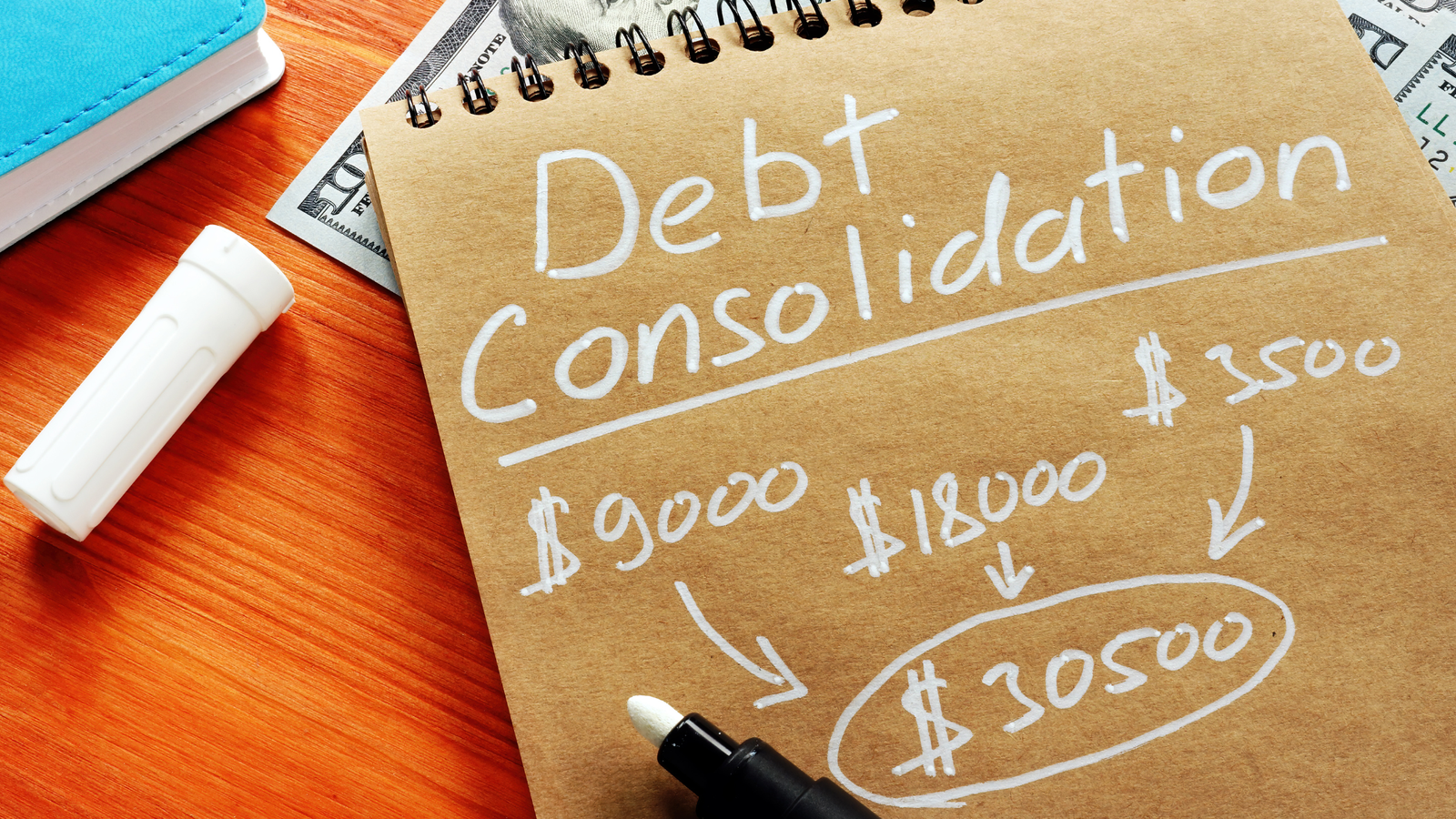

2- Debt Consolidation

Our next solution for debt relief is debt consolidation. This process involves taking out one big loan (usually from a debt consolidation company) to pay off all your debt from different creditors. The loan pays off any debt you have, and then you work to pay off the loan. For example, if you have $10,000 in student loans from one company and $5,000 from another, you would combine them into a $15,000 consolidation loan that you pay off monthly.

Debt consolidation is an excellent solution for people who have difficulty managing the payment timing, amounts, and interest rates on many different loans. With this method, you’ll only have to make one monthly payment. However, these loans may have higher interest rates or steeper penalties for not paying. Use our Genius Guide to quickly compare the best debt consolidation companies to work with today.

3- Debt Relief

Debt relief is the process of negotiating a new, lower payment with a creditor to pay off a debt. The catch, however, is that you’ll need to pay the settlement in a lump sum. So, if you have $10,000 in student debt and you settle it for $6,000, you’ll have to pay that 6k pretty soon.

Debt relief companies can help make the process easier since they can directly speak with your creditors with little difficulty and are experts at negotiating your settlement. After working with a debt relief company, you’ll pay them a monthly fee for your debt settlement, along with a separate fee for their services.

Depending on how easy it is to contact your creditor, there’s also the option of working alone. This can help you avoid debt relief companies’ fees but may also be more time-consuming. Use our Genius Guide to quickly compare the best debt relief companies to work with today.

4- Look Into Loan Forgiveness

Loan forgiveness is one of the best ways to eliminate debt because the process doesn’t involve making any payments. Instead, debt forgiveness is what it says on the tin: your creditor releases you from paying all or part of the debt you owe. Tons of nonprofits specialize in debt forgiveness, where, if you qualify, you can apply with them to have a portion of your debt paid off.

The catch with debt forgiveness is that if your debt is completely forgiven, you won’t have the opportunity to use it to build a credit score.

5- Student Loan Forgiveness

Student loans are one of the most frequently forgiven debts out there. Some government institutions, like Medicare for younger disabled people, have debt relief programs to help disabled persons pay off their student debt in full. There are also plenty of charities that specialize in student debt forgiveness for qualifying students.

Depending on your income after graduation, you may qualify for the new Biden-Harris debt relief program. It forgives up to $20,000 of student debt for anyone making less than $125,000 per year.

6- Look into Balance Transfer Cards

If you’re dealing with credit card debt from multiple creditors with varying interest rates, consolidating them with a balance transfer card may be your best choice. Balance transfers work best for smaller amounts of debt as opposed to bigger things like mortgages and loans. With a balance transfer, you are essentially putting any outstanding credit you have onto another card with a lower interest rate. So if you’ve got three credit cards, each with $100 on them, you can transfer any extra balance you have onto a new card. Then, you’ll only have to focus on paying that one off.

Balance transfers are perfect if you’re looking to keep working on your credit score while also keeping all your debt organized. They can also help stabilize your credit card interest rates, giving you a more accurate timetable for paying them off. However, balance transfers still require a processing fee and don’t work well for large loans.

7- Pay Your Bills on Time… and Communicate!

The final way we recommend getting out of debt is to pay your bills on time while staying in contact with your bank and your creditors. It can be easy to fall into the trap of automatic payments suddenly overdrawing your account, and it’s stressful seeing your accounts frozen from not paying your bills. So, the best way to mitigate that is to talk! Consult your creditor for details on automatic payments before signing up for them, and speak with both your creditor and your bank about the timing of transfers and paychecks to process.

Remember, you are not alone– everyone is in some sort of debt, and getting out of debt isn’t something you have to go through by yourself.

In Conclusion

Getting out of debt is a journey that requires careful planning and dedication. Now that you’ve explored six effective strategies for debt relief, the next step is to choose the one that best aligns with your financial situation and goals.

Your roadmap to a debt-free future begins with informed choices and responsible financial practices.